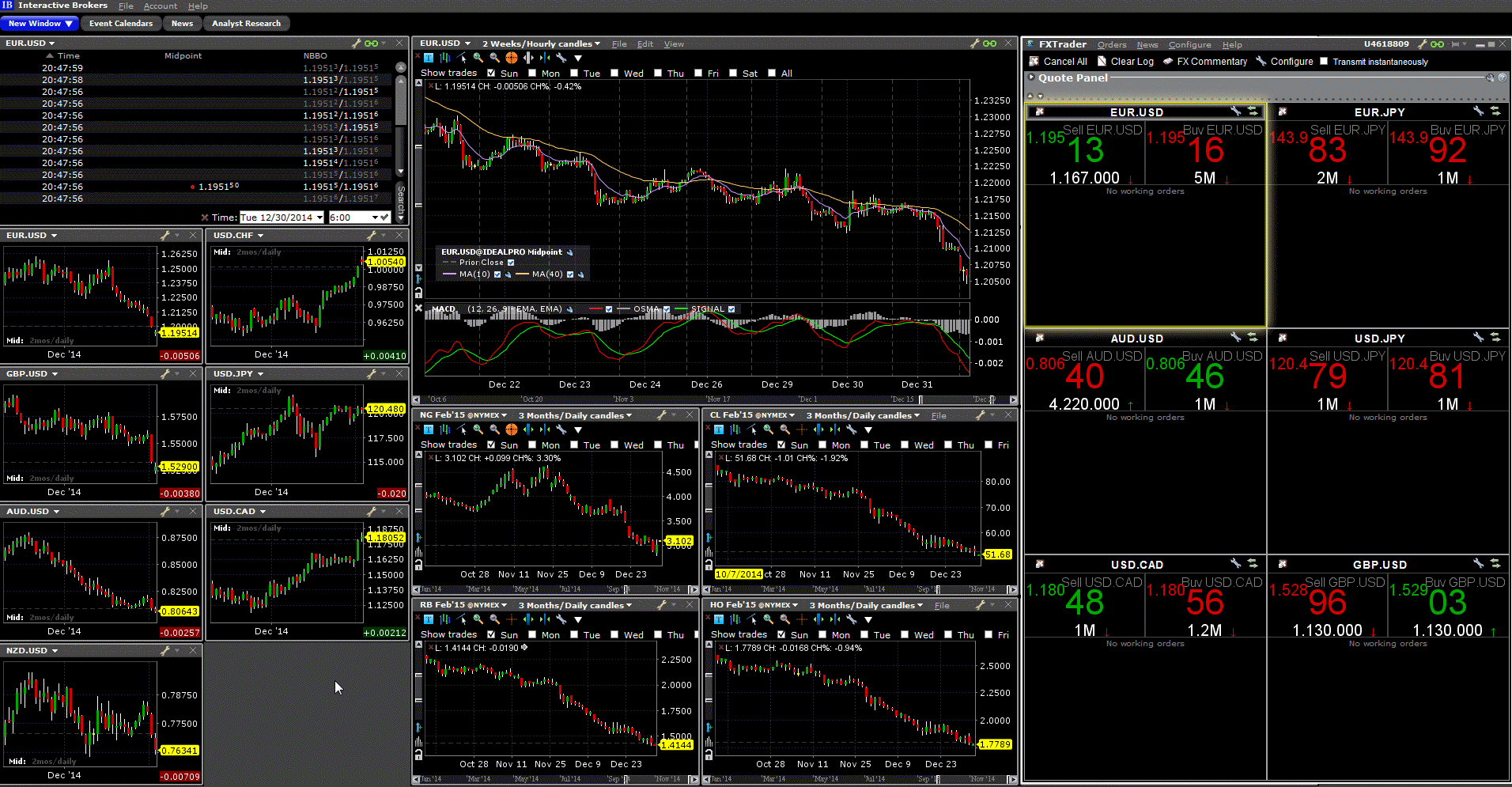

Connection to Interactive Brokers is made through their TWS trading platform or the IB Gateway application. To successfully connect to IB you need to run their applications. If you have any other problems during the connection to Interactive Brokers, please contact us in support and we will help you. Book a 1 on 1 Live Call with Me! ☎️interactive brokers TWS platform setup for scalping options. I'm an options scalper so I.

TWS RTD Server API is a dynamic link library which allows user to request real-time market data from TWS via API using Microsoft Excel®. The TWS RTD Server API directly uses the C# API Client source, which connects to TWS via the socket. It allows displaying streaming live (or 15-minute delayed) market data in Excel by entering formulas into an Excel cell following a specific syntax.

Note: At the current stage, only top-level market data is supported via TWS RTD Server API. No trading capability or other data types are supported. Both Delayed and Real-Time data are supported via TWS RTD Server API. Market Data Subscription is required for requesting live streaming market data.

- Windows Operating System

Since the TWS RTD Server API technology directly refers to the C# API client source functions, it is supported on Windows Environment only.

- API version 9.73.03+

You need to download IB API Windows version 9.73.03 or higher and install on your computer. Once you have installed the API, you can verify the API Version by checking C:TWS APIAPI_VersionNum.txt by default.

- TWS (or IB Gateway) Build 963+

By default, market data requests sent via TWS RTD Server will automatically request for all possible Generic Tick Types. There are several generic tick types being requested that are only supported in TWS 963 or higher. Sending any RTD market data request with default generic tick list to an old build of TWS will trigger a 'TwsRtdServer error' indicating incorrect generic tick list is sent. Make sure a TWS builds 963+ is downloaded from IB website and kept running at the background for TWS RTD Server API to function properly.

- Enable Socket Client in TWS (or IB Gateway)

Since the TWS RTD Server API directly refers to the C# API source, RTD market data requests will be sent via the socket layer. Please make sure to Enable ActiveX and Socket Client settings in your TWS.

Please also be mindful of the socket port that you configure in your TWS API settings. The default socket port TWS will listen on is 7496 for a live session, and 7497 for a paper session. It is further discussed in section Connection Parameters that TWS RTD Server connects to port 7496 by default, and you are able to customize the port number to connect by specifying pre-defined Connection Parameters or using rtd_complex_syntax string 'port='. You can use any valid port for connection as you wish, and you just need to make sure that the port you are trying to connect to via the API is the same port your TWS is listening on.

- Microsoft Excel®

After installing the API, the pre-compiled RTD library file (located at C:TWS APIsourcecsharpclientTwsRtdServerbinReleaseTwsRtdServer.dll by default) registered on your computer will be in 32-bit by default for API versions from 973.03 to 973.06. If you are using 64-bit Microsoft Excel, you would need to re-compile RTD server dll file into 64-bit and register the library by re-building the RTD source solution using Visual Studio. Please refer to the TWS Excel APIs, featuring the RealTimeData Server recorded webinar for more information. Beginning in API v973.07* it is expected that the API installer for RTD Server will be compatible with both 32 bit and 64 bit Excel (* expected version number).

Customer can request market data by entering the following formula with corresponding parameters into an Excel spreadsheet cell:

=RTD(ProgID, Server, String1, String2, ..)

where 1994 calendar malayalam.

- ProgID = 'Tws.TwsRtdServerCtrl'

- Server = ' (empty string)

- String1, String2, .. is a list of strings representing Ticker, Topic, Connection Parameters or other Complex Syntax strings.

Note: TWS RTD Server API formula is not case-sensitive.

There are three ways to compose an RTD Formula:

A resourceful Syntax Samples page is provided for demonstration of RTD formulas categorized by security type using different syntaxs.

Besides reading through the written documentation, you can also watch the TWS Excel APIs, featuring the RealTimeData Server recorded webinar for a more interactive tutorial video.

- It is important to keep in mind the 50 message/second API limit applies to RTD Server in the same way as other socket-based API technologies. So the Excel spreadsheet can send no more than 50 messages/second to TWS. Each subscription or cancellation request counts as 1 message (messages in the opposite direction are not included). So a spreadsheet can have hundreds of streaming tickers, but the subscriptions must be spread out over time so that no more than 50 new subscriptions are made per second, or the spreadsheet can become disconnected.

An Interactive Brokers volume profile can be added to TWS charts and today you will learn how to do it. We will look at a couple of examples too.

Contents

What Is A Volume Profile Chart?

Within Interactive Brokers, or any broker to be honest, a volume profile chart can be useful for both short-term traders and long-term investors.

A volume profile chart, sometimes referred to as a market profile chart, gives clues as to the points of control for a stock.

With price, volume and time period shown on a single chart, the Interactive Brokers volume profile can show potential levels of support and resistance.

:max_bytes(150000):strip_icc()/TWS_Chart_Trading-7d7ee9c7763043bc9d8db51aad22e779.png)

Below is an example of a 15-minute chart of AAPL taken from late June 2021.

From the volume histogram on the right, we can see that there is a potential level of support around 132.

Trades may use this information to structure a bull put spreadtrade with the view that AAPL will not break through 132.

How To Read Interactive Brokers Volume Profile

The volume profile chart is similar to a regular chart in that we have price on the vertical scale (y-axis) and time on the horizontal scale (x-axis).

We have now added a third parameter which is the volume histrogram to the right of the price labels.

The longest horizontal lines represent the largest amount of trading volume.

Soundtoys little alterboy crack. The price level with the greatest volume is known as the point of control.

Going back to our AAPL example, bulls took control once price broke out above 132 and went on a quick rally to 134.

This can be very useful information for short-term traders.

Below is the same chart but using hourly candles.

We can see a lot of volume between 129.50 and 132.

This should provide a strong support going forward.

Likewise, there is a volume void between 127.50 and 129.

Interactive Brokers Tws Api

Therefore, if AAPL breaks below 129, prices could quickly decline to 127.50 due to the lack of volume support.

Here we have another example using BAC.

This time we see the point of control is above the current stock price. Premiere graph editor.

Interactive Brokers Tws Login

- Microsoft Excel®

After installing the API, the pre-compiled RTD library file (located at C:TWS APIsourcecsharpclientTwsRtdServerbinReleaseTwsRtdServer.dll by default) registered on your computer will be in 32-bit by default for API versions from 973.03 to 973.06. If you are using 64-bit Microsoft Excel, you would need to re-compile RTD server dll file into 64-bit and register the library by re-building the RTD source solution using Visual Studio. Please refer to the TWS Excel APIs, featuring the RealTimeData Server recorded webinar for more information. Beginning in API v973.07* it is expected that the API installer for RTD Server will be compatible with both 32 bit and 64 bit Excel (* expected version number).

Customer can request market data by entering the following formula with corresponding parameters into an Excel spreadsheet cell:

=RTD(ProgID, Server, String1, String2, ..)

where 1994 calendar malayalam.

- ProgID = 'Tws.TwsRtdServerCtrl'

- Server = ' (empty string)

- String1, String2, .. is a list of strings representing Ticker, Topic, Connection Parameters or other Complex Syntax strings.

Note: TWS RTD Server API formula is not case-sensitive.

There are three ways to compose an RTD Formula:

A resourceful Syntax Samples page is provided for demonstration of RTD formulas categorized by security type using different syntaxs.

Besides reading through the written documentation, you can also watch the TWS Excel APIs, featuring the RealTimeData Server recorded webinar for a more interactive tutorial video.

- It is important to keep in mind the 50 message/second API limit applies to RTD Server in the same way as other socket-based API technologies. So the Excel spreadsheet can send no more than 50 messages/second to TWS. Each subscription or cancellation request counts as 1 message (messages in the opposite direction are not included). So a spreadsheet can have hundreds of streaming tickers, but the subscriptions must be spread out over time so that no more than 50 new subscriptions are made per second, or the spreadsheet can become disconnected.

An Interactive Brokers volume profile can be added to TWS charts and today you will learn how to do it. We will look at a couple of examples too.

Contents

What Is A Volume Profile Chart?

Within Interactive Brokers, or any broker to be honest, a volume profile chart can be useful for both short-term traders and long-term investors.

A volume profile chart, sometimes referred to as a market profile chart, gives clues as to the points of control for a stock.

With price, volume and time period shown on a single chart, the Interactive Brokers volume profile can show potential levels of support and resistance.

Below is an example of a 15-minute chart of AAPL taken from late June 2021.

From the volume histogram on the right, we can see that there is a potential level of support around 132.

Trades may use this information to structure a bull put spreadtrade with the view that AAPL will not break through 132.

How To Read Interactive Brokers Volume Profile

The volume profile chart is similar to a regular chart in that we have price on the vertical scale (y-axis) and time on the horizontal scale (x-axis).

We have now added a third parameter which is the volume histrogram to the right of the price labels.

The longest horizontal lines represent the largest amount of trading volume.

Soundtoys little alterboy crack. The price level with the greatest volume is known as the point of control.

Going back to our AAPL example, bulls took control once price broke out above 132 and went on a quick rally to 134.

This can be very useful information for short-term traders.

Below is the same chart but using hourly candles.

We can see a lot of volume between 129.50 and 132.

This should provide a strong support going forward.

Likewise, there is a volume void between 127.50 and 129.

Interactive Brokers Tws Api

Therefore, if AAPL breaks below 129, prices could quickly decline to 127.50 due to the lack of volume support.

Here we have another example using BAC.

This time we see the point of control is above the current stock price. Premiere graph editor.

Interactive Brokers Tws Login

If BAC does rally, the stock will likely have a hard time getting above the 41 – 42 area.

How To Add Volume Profile In How To Read Interactive Brokers Volume Profile

Unfortunately, it is not obvious how to add the volume profile to Interactive Brokers charts, but luckily, you've come to the right place.

Within the chart, go to View and then Volume Histogram.

See the image below for details.

Toggle the radio button to on and you are good to go.

It may take a few seconds for the volume profile to populate, I guess there are some heavy calculations that need completing in the background.

One other thing to note is that it appears only possible to add the volume histogram to hourly charts and other short-term charts.

Daily charts do not seem to have it which is quote annoying.

Conclusion

There you have it.

Now you know how to add volume profile to Interactive Brokers charts and how to read it.

We hope it helps you in your trading.

Trade safe!

Gav.

Interactive Brokers Tws Hotkeys

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.